April CPI results yesterday morning were in-line at first glance, but peeling back the layers of the onion, underlying results were much more positive. Let's review.

Headline and "Core" CPI both increased 0.4% in April, both in-line with consensus expectations. The components of the 0.4% core increase were: 15 bps from goods, 17 bps from shelter (a large component of the services basket), and importantly, 4 bps from services ex. rent (the difference between these figures and the 0.4% reported is due to rounding). There's several important takeaways here.

First, everyone had been waiting for CPI to reflect the resurgence in used car prices over the last several months, and this month saw that in a big way. 14 of the 15 bps contribution from goods this month to overall core CPI came from used cars. Goods away from used cars was basically flat, which is in-line with its pre-COVID average. Goods inflation has been a little more persistent than expected in recent months, but this month gets the normalization story back on track, as labor shortages continue to become less and less of an issue, which itself has contributed to further normalization in supply chains and shipping costs. This is all good, and now that used car prices have begun to fall again in April (https://publish.manheim.com/en/services/consulting/used-vehicle-value-index.html), the large 14 bps contribution from that category is likely not going to continue, especially now that the new car market feels like its continuing to normalize (though perhaps still more slowly than we'd like).

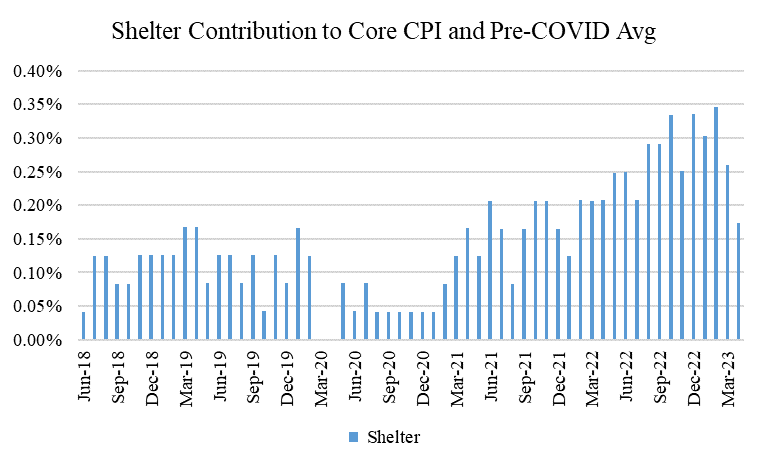

Second, the shelter component of CPI continues to catch up to the on-the-ground realities of the housing market, which has shown flat to declining rent and home prices since last year. This month's contribution of 17 bps was the lowest since January 2022's 12 bps contribution, and also appears to be quickly moving back to the pre-COVID contribution of ~11 bps. This too is good news, and further catch-up should drive down reported CPI in coming months.

Third, the services ex. rent bucket, or "core services," showed improvement as well. Notably, in several months recently, medical care had provided a tailwind to the core services basket due to the mechanics of how CPI calculates medical insurance. This month, core services both including and excluding medical care showed improvement. This too is now knocking on the door of its pre-COVID average, as shown in the charts below.

Lastly, looking at inflation on a category level also showed encouraging results about inflation breadth. As a reminder, I like to look at what I call "sub-indent 4" of the CPI, which breaks down the CPI into 55 baskets of goods and services comprising 98% of the CPI. Looking at the average and median increases of these baskets helps give us a better sense of inflationary breadth. The more categories increasing above the Fed's inflation target (2% on an annualized basis), the worse the inflationary breadth. And of course, if more categories are starting to increase less than 2%, that's more reason to feel encouraged. This month's average and median increases for this group of 55 categories was 18 bps and 10 bps, respectively, both of which annualize to below the Fed's 2% inflation target. Notice in the charts below how the lines are below the bars. That tells you inflationary breadth is weakening (or getting better).

All of this helps support the case for the Fed make no changes to its interest rate policy in June (otherwise known as a "pause"). That being said, because the headline figures for both headline, core, and 3-month average core readings remain elevated on an annualized basis (see chart below), absent more stresses in the banking system or other evidence of economic weakness, the Fed will probably continue its reticence towards cutting interest rates later this year like the market expects. This is certainly a fluid situation though, so we'll have to see how this plays out. More to come on this next month.

Comentários