Below are both macro datapoints and "micro" commentary from publicly traded companies on inflation over the last week. As long as inflation remains the key issue in American economic life, I'm going to try and put this out every week. Also, I am attempting to aggregate as many alternative price index data sets as possible for this, so if you know of any that are free (examples I've already got are: Adobe's Digital Price Index, Manheim's Used Car Index, STR's weekly and monthly hotel data, etc.), I'd love to add it to my list. Email me at justin@citizenanalyst.com if you've got one you think fits the bill. Thanks in advance!

S&P Markit September US Flash PMI Survey (this is a large survey of businesses across the country that comes out once a month)

“For the fourth month running, the rate of input cost inflation eased during September. The pace of increase was the slowest since the start of 2021, as manufacturers and service providers recorded slower upticks in operating expenses.”

“That said, cost burdens continued to rise at an historically elevated pace, with interest rate hikes and material and wage increases driving inflation.”

“Reflecting softer rises in cost burdens, firms increased their selling prices at a slower pace at the end of the third quarter. That said, the moderation was led by service providers as manufacturers registered a sharper uptick in output charges in an effort to pass on higher costs to clients.”

“Manufacturers continued to note difficulties in working through orders due to transportation and supply chain disruption, with capacity constraints hampering service providers for the first time since May.”

“Inflationary pressures across the service sector remained substantial in September. That said, the rate of cost inflation softened to the slowest since January 2021 amid reports of drops in some material costs. In an effort to drive sales, firms passed on cost savings to their clients where possible, which led to the slowest uptick in output charges for almost two years.”

“Firms sought to expand workforce numbers, but higher wage costs and challenges finding suitable candidates weighed on overall job creation, which eased to the slowest in 2022 so far.”

- Re: Manufacturing

“Although input costs increased at a softer pace during September, firms raised their output charges at a sharper rate. Average operating expenses rose at the slowest pace since November 2020, as some material prices reportedly fell. Historically elevated increases in costs were, however, partially passed on to customers.”

“The softer rise in input costs was also partially due to a less marked deterioration in vendor performance. Lead times lengthened to the smallest extent since October 2020, as some firms noted reprieves in the supply of certain materials and less severe transportation delays.”

- Summary comments from S&P Chief Economist Chris Williamson:

“There was also better news on inflation, with supplier shortages easing to the lowest since October 2020, helping take some of the pressure off raw material prices. These improved supply chains, accompanied by the marked softening of demand since earlier in the year, helped cool overall the rate of inflation of both firms’ costs and average selling prices for goods and services to the lowest since early-2021.”

“Inflation pressures nevertheless remain elevated by historical standards and, with business activity in decline, the surveys continue to paint a broad picture of an economy struggling in a stagflationary environment.”

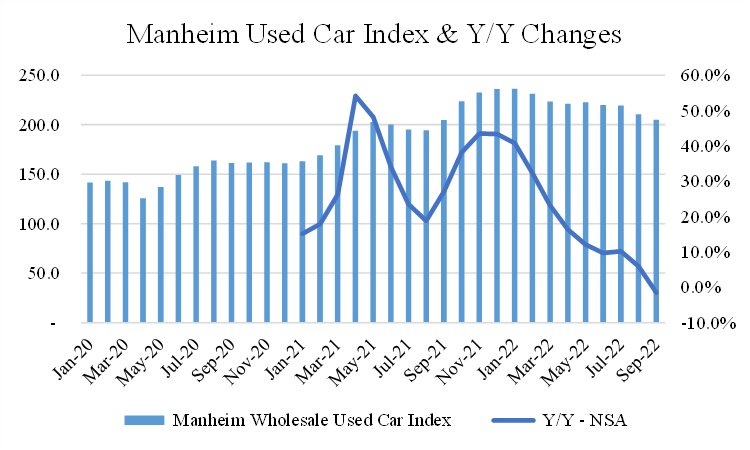

Cox’s Manheim Used Vehicle Index declined at the wholesale level continued to fall the first half of September, indicating car prices are likely to continue to fall at the retail level soon. Changes in used car prices at the wholesale level lead retail prices at dealerships. Car prices are now barely up on a year-over-year basis at 0.6%.

“Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) declined 2.3% from August in the first 15 days of September. The Manheim Used Vehicle Value Index fell to 205.9, which was up only 0.6% from September 2021.”

https://publish.manheim.com/en/services/consulting/used-vehicle-value-index.html

Below shows Manheim’s index versus Used Car Prices in the Consumer Price Index (CPI), and shows that Manheim tends to lead CPI by several months. It also indicates that used car profit margins at dealers may be keeping retail prices elevated for longer, which is likely to eventually compress as used car supply has normalized considerably. This should also trend better as new car production improves as well.

The Philadelphia Fed released their Nonmanufacturing Business Outlook Survey for September on 9/22 (https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/nonmanufacturing-business-outlook-survey). This asks businesses in the non-manufacturing sectors about whether their prices paid for goods and received (selling prices) are going higher, lower, or staying the same. In keeping with the trend in other services surveys, inflation for both inputs and finished goods ticked up month-over-month (seasonally adjusted). Generally manufacturing surveys of late have shown more improvement in these surveys than their services counterparts, which makes sense as consumers shift away from elevated goods spending (reducing pressure on supply and demand) and move back into services.

The manufacturing and services survey results from the Kansas City Fed (which asks similar questions about prices as the Phila Fed) released on 9/22 and 9/23 somewhat substantiated this trend, but were a bit aberrational in some cases as well (https://www.kansascityfed.org/surveys/manufacturing-survey/). Manufacturing indices ticked up ever so slightly after several months of rapid improvement. Services showed both input costs and selling prices declining slightly during the month.

On Wednesday, the National Association of Realtors released August home sales data (https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales). The data showed heavier than normal declines for this time of year, and provided further indication that home prices are coming down. The year-over-year figures are still up, but coming in considerably and are not far away from their pre-COVID annual increases of 5-10%.

Weekly Realtor.com data continues to show the same thing. Listing prices for homes continues to come down, and reducing the year-over-year increases with it.

Additionally, on Thursday, despite the negative title, Realtor.com’s August Rental Report (https://www.realtor.com/research/august-2022-rent/) shows that rents appear to have peaked, and the year-over-year increases coming down fairly quickly as well. This is another disinflationary and in some cases deflationary trend in the housing market.

Here are this week’s public company commentary on inflation. All italicized text is mine, with normal fonts being direct quotes from company executives.

Autozone (Ticker: AZO)’s F4Q22 (quarter ending July 31) – Auto Parts Retailer

This quarter, we saw our sales increase by 11% from inflation, in line with cost of goods, which was up about 10%. We believe both numbers for the first quarter will be similar. As rising raw material pricing, labor and transportation costs are all impacting us and our suppliers, inflation has been prevalent in the aftermarket space. We believe inflation is stabilizing. We are seeing transportation costs begin to moderate after reaching historic levels, but we are not seeing product cost deflation yet nor are we seeing any signs that labor wage growth is slowing.

On supply chain: It's still quite challenging. And it's moved. I've talked about it over time. It moves from one category to another one. Most of our hard part categories, we're in pretty good shape on. We have some challenges in areas like filtration. But generally, we're in pretty good shape, but we are still a couple of points behind our overall in-stock rate that we had before the pandemic. It's been very stubborn, frankly. We're looking to push through it. But every time we think we've got it solved, in other category rears its ugly head.

We are starting to see freight moderate some in the spot markets. However, what I'll remind you is that when we were in this environment of trying to make sure that we had capacity, we were incurring higher freight charges just so that we could secure capacity. So as those short-term contracted capacity dynamics happen from freight start to roll off, we'll start to see the benefits of what we're starting to see in the marketplace, which is a moderating freight market. You could see this in the back half, get better, barring any disruptions… We're monitoring what's happening in the freight markets. It will come back. It's already starting to come back. And what you'll see is that we'll get credits coming back through the P&L to offset the charges that I've talked about for the first and the second quarter.

First of all, I've been involved with this company since before we went public in 1991. This is the first time we've ever had a LIFO charge period. These are uncertain times or unique dynamics, especially with the level of inflation that we've seen in cargo freight going from $1,800 to over $20,000 per container. Those numbers have moderated significantly now, but we do have some long term -- or some midterm contracts, call them 6 to 12 months where we had to secure capacity. It is our full expectation, and I don't know if it will happen this year or not. It's going to depend on freight costs. It is our full anticipation whatever charges we take in Q1 and Q2 ultimately will be reversed, and we will go back to 0 and then we'll start building a LIFO reserve that we don't record. So we think this $100 million to $200 million charge will be temporary, and it will reverse and it could be -- the back half of this year, could be next year, but that is fully our expectation.

Re: seeing signs of consumers trading down: Yes, it's a great question, Greg. It's something that we have been studying really since probably May. We have seen it at times on the margin. But really -- I mean, we've really looked for it hard. We have not seen it in mass by any stretch of the imagination at this point in time.

YUM! Brands (restaurant company) presenting at JP Morgan Conference:

So in that roughly 60% of the world -- if you go to the 40% emerging markets, in many of those markets, our jobs are aspirational jobs. And -- but even in the developed markets, we strive to provide a great experience for our team members day in and day out. And we think our franchisees do an awesome job of bringing our people-first culture to life in their restaurants. Now it has been a challenging time in these labor markets because of the structural challenges. So if I take the U.S., you've got the structural questions about labor force availability that has existed now for -- going on a year, and then we probably hit the most challenging point in January where, layered on top of that, we had the Omicron challenges. Things have gotten significantly better from that point in the U.S. They're not back to 2019, the 2019 sort of environment. If you talked to one of our franchisees or one of our COOs, they'd say this is still a challenging time. But we're -- applications are up from January. Our hours in the restaurant are up, not quite back to 2019 levels, but things have gotten better.

The most challenging job, though, to hire has been the driver job in the Pizza Hut business. And I think it's because there are so many other options for drivers now in the gig economy, being a rideshare driver. And of course, we're changing some of our processes to deal with that. We had this insight that if it takes longer than about 4 minutes to apply for a job, people drop out of the process because that's how long it takes in the other options. So we've shortened our application process, and Pizza Hut is an example. And of course, we're also -- back to the earlier conversation, Pizza Hut now is working with the aggregators, either going on the platform or using the aggregator providers as a white-label solution where you order on the Pizza Hut app. But then if the restaurant doesn't have enough labor to do the delivery itself, they can use that as a relief valve, and that order would be delivered by one of the aggregator drivers. So those are the ways that we're dealing with that specific issue.

Darden Restaurants F4Q22 Call – Restaurants operator

We are also leveraging our scale to help mitigate the impact of heightened inflation. During the quarter, we continued to experience significant commodities cost pressure, and our supply chain team did an excellent job of working with the suppliers to minimize or offset cost increases to the extent possible. Inflation remains a headwind for consumers as well, particularly those in households making less than $50,000 a year. Olive Garden and Cheddar's have more direct exposure to these guests. Looking at guest behavior across our entire portfolio, we are seeing softness with these consumers, while conversely, we are seeing strength with guests and higher-income households.

In the first quarter, total inflation was roughly 9.5% and total pricing was approximately 6.5%, almost 300 basis points below inflation. We expect total inflation and our gap between pricing and inflation to have peaked in the first quarter.

For perspective here, in F4Q (C2Q22), they stated “We continue to see increasing cost pressures with total inflation for the fourth quarter of 7.5%. During the quarter, we took additional pricing to help offset a portion of the growing inflation that brought total pricing to 6% for the quarter and 3% for the full year. This is well below our annual inflation of just over 6%, as we continue to execute our strategy to strengthen our value leadership position.”

The quarter before that, they cited "We also expect inflation to moderate throughout the remainder of the year while our pricing gap should narrow in both the fast -- I'm sorry, both the second and third quarter and then reverts in the fourth quarter. And while we have commodities inflation risk in the back half of the year, we have pricing plans ready to put into action, which will help preserve our targeted gap to inflation for the year if we see inflation higher than our expectations. Consistent with what we expected and communicated in the June call, the significant level of pricing below inflation pressured all aspects of our P&L in the first quarter and drove margins well below last year. As we look to the second quarter, we expect margins to decline less than they did in the first quarter and then grow versus last year in the back half

Total restaurant labor inflation was 7.5%. Restaurant expenses were 10 basis points above last year driven by higher repairs and maintenance expense due to supply chain challenges and utilities inflation of 16%.

Last quarter they said “Restaurant labor was 40 basis points lower, driven by hourly labor efficiencies gained from operational simplifications, which were partially offset by continued wage pressures. Total restaurant labor inflation was 7% versus last year, primarily driven by hourly wage inflation of approximately 9%.”

Finally, looking at the second quarter, we've seen continued strength in our sales trends with quarter-to-date sales above the high end of our annual same-restaurant sales outlook range. We also expect commodities inflation close to 13% and pressuring the second quarter EPS to be flat to slightly below last year.

First of all, I want to remind you that the commodities inflation, when we talk about inflation is really a function of what we purchased last year at what price. And for us, I'll take one great example is we had a great chicken contract. I think we were buying boneless chicken breast in the range of, call it, mid-$1 range and as you all know, I think 2, 3 months ago, the price of that was as much as $3.50. And I think this week, it traded -- it's come down to almost $1.80, $1.85, right? So it's come down a lot. The pricing level, we are definitely seeing the movement in the right direction. But we had expected some of that to happen as we guided. And in fact, directionally, things are moving consistent with what we expected, maybe not as quite as fast as we thought. But it's not that far off. I mean our commodities inflation for the year. At the beginning of the year, we said we're around 7%. We're probably looking at closer to 7.5%, but that's not a huge change given the volatility we've had in the market. But as we get to the back half, we do wrap on some of these elevated costs. And so as we look at quarter-to-quarter. We do expect as we get into Q3 to be more in that mid-single-digit range. And as we get to Q4, probably more close to flat to slightly deflationary year-over-year. The other thing is we have -- our coverage, it's really still hard to get coverage too far out. And as you can saw from this morning, I think we showed it in the amount of coverage in our slides here. I think we have 50% coverage over the next 6 months. And in fact, when you look at the next 3 months, that's just over 70% but then after that, it's only -- it's closer to 30% coverage. And so it's still hard to get -- the forward premiums are still high, and we -- especially when things are coming down, we don't want to lock ourselves not have that optionality. But again, as I said in my comments earlier, if it ends up being a little bit higher, we have had room in pricing to be able to deal with that.

Yes, we're going to in a scenario that food costs deflate even more or reduce even more than we have in our estimate already. Because remember, what I said in the June call and even today is we continue to expect food cost to go down, the inflation to go down from where it was in the first quarter. And I'm assuming that our competitors are assuming the same thing.

Yes. We continue to get a significant increase in applicant flow across the country. We have a new talent management system. We've had it for over a year. And that system allows applicants to automatically schedule their interviews, et cetera. And we've got so many interview schedule. We're going to have to figure out how to maybe slow that down because managers of all they're doing is interviewing in a lot of places. So we've got a really good applicant flow. As we said, we opened quite a few restaurants this quarter. All of them were fully staffed with great people ready to go. Our turnover, our manager retention is much closer to pre-COVID levels. It's pretty close to pre-COVID levels and well better than the industry average. Our manager retention. And our team member retention is also well above the industry, but it's not quite back to pre-COVID levels. So our teams are focused and as we mentioned, we had our General Manager, managing partner conferences last month. And most of those conferences we're talking about ensuring that we train our new team members and improve retention. We think that's a key for us going forward, and we'll continue to focus on trying to get our retention levels back to pre-covered levels.

On the labor front or the staffing front. So a couple of things. One, yes, when we hire when we have a lot more hires than we normally do because we were trying to fill our restaurants back up and when our turnover is a little bit higher than it used to be, that leads to higher training. But we've got a great employment proposition. We're continuing to build up our certified trainer ranks. Some of them left the industry when COVID happened. So we're going to -- we're just going to ensure that we do what we did before COVID. We're going to make sure when we hire somebody, they get onboarded like they should at Darden restaurant that they go through the training, all of the training, and they're not just kind of thrown into the woods because of short staffing, the fortunate thing is we're not really short staffed. So we have time to spend to train our team members in our industry, like many service industries, most -- a lot of the turnover happens in the first 90 days. And so when you spend the time on training somebody and they leave within 90 days, there's a lot of cost. So we're focusing our efforts on hiring the right people and training them to our standards, so they don't leave in the first 90 days. And if we can just get that back to close to pre-COVID levels, our retention is going to be back to pre-COVID levels. and that will save a lot of money on the P&L.

And Raj, I think you said hourly wage inflation up around 9.5%. And up a little over 9% in this quarter. I guess with staffing levels recovered, I'm curious to what degree do you expect hourly inflation to moderate over the next few quarters?

Yes, Brian, we expect for the full year to be around 8%. So that has implied there's some moderation as we go through the year. Yes, you're right. We started with a little bit over 9% in the first quarter. But again, we had -- if you look at last year cadence, you got to look at that there was a step-up in the back half of last year. So as we wrap on that, we don't expect it to be at those levels, yes.

Yes, the total labor is somewhere in that 6% to 6.5% year-over-year because last year, we already got all the productivity last year. So we don't see a year-over-year significant improvement in productivity. In fact, as I was mentioning, first quarter, we were wrapping on elevated productivity from last year. But 6% to 6.5% for total labor is how we're looking at it. That includes the indirect labor as well, the manager salary and all that stuff.

HB Fuller (Ticker: FUL) – Adhesives Company

We are beginning to see signs that raw material cost inflation may be leveling off in the fourth quarter.

From a planning perspective, we're expecting stabilization of supply and pricing of raw materials.

Yes. Raw materials have definitely peaked, doesn't mean they can't come back. But Q2 was the peak. I think we expected a slight decline in Q3. We saw a slight decline in the amount of inflation, right? It was a much lower level of inflation in Q3 than Q2. So Q2 was the peak. As I said in the commentary, we're expecting rolls in Q4 net-net, some will be up, some will be down, to be relatively flat to Q3.

Yes. So supply chains are definitely improving, but they're still fragile, right? So I would say versus where we were the last 3, 4 quarters, we're much better, but versus normal, we're not there yet

Lennar Corp (Ticker: LEN) – Homebuilding Company

Now I'd like to turn to the current state of the supply chain. Our third quarter continued presenting some favorable cycle time results while still dealing with ongoing disruptions from certain material shortages. Although it was minor, it's still significant that we achieved a 3-day reduction in cycle time in Q3 from Q2.Additionally, over 50% of our markets experienced cycle time reductions in the third quarter compared to 25% in the second quarter.

The primary material disruption in the third quarter was related to the delivery of electrical equipment such as switchgear, multimeter boxes and pad-mounted transformers.

Construction labor remains very tight as industry-wide high levels of volume for second half deliveries moves through the various stages of construction. We expect to start seeing some easing in labor as the overall industry reduces the level of construction starts. This easing should start to first occur in the fourth quarter with front-end trades and in the first quarter with finished trades

As expected, cost increased in our third quarter as increases from lumber that spiked in Q1 flowed through our third quarter closings. We also saw increases in other material costs and labor in Q3 closings, resulting in a total direct construction cost increase of 6% and 21% sequentially and year-over-year, respectively. As a reminder, the drop in lumber prices we saw earlier in the year materially benefited the cost of our starts in the third quarter and will flow through deliveries in the first half of 2023.

Last quarter, they stated: “Turning to the supply chain and it's well-documented challenges for the industry. Our second quarter started presenting some favorable news. There were still intermittent disruptions and an increase in construction costs. But for the first time since the disruptions began, we saw a flattening in cycle time. Over the past 4 months, cycle time has expanded by only 5 days, which we believe signals a peak. Additionally, about 25% of our markets experienced cycle time reductions in the second quarter compared to the first quarter. There are still challenges that occur, but we are managing them effectively as evidenced not only by this flattening of cycle time, but also by being above the high end of our guidance for second quarter closings. Our direct introduction costs in the second quarter were up 1.6% sequentially and 20% year-over-year, both lower than the comparable increases for the same period in the first quarter and fourth quarter of 2021. Rise in labor costs accounted for all of the increase in the second quarter. Material costs were lower due to the lower priced lumber from starts in the second half of last year. We expect costs will rise again in the back half of 2022, as increases in lumber that spiked in Q1 will flow through those closings. The current drop in lumber prices that we're experiencing, which started near the end of our second quarter will lower the cost of our starts in the second half of this year and related to deliveries in the first half of 2023.”

FreshPet (Ticker: FRPT) at JP Morgan Conference – Fresh food manufacturer for Pets

In 2020 and 2021, we did do advertising in the fourth quarter of the year because our supply was coming back. So we're getting supply back, and we wanted to start being able to ramp into the next year with a little bit of a tailwind. That's not an issue here. We're pretty much back in stock everywhere. That's not a dynamic at play here.

One is from an economics perspective, I think we're in for a recession. I think most people think we're in for a recession, but I view it as a positive. Because the supply chain is so broken in this country right now, we need cost to come down and we need supply reliability to come up so that we can all operate much more efficiently. And I think a short and not very deep recession would serve all of us in this industry well because it will finally normalize a lot of the (inaudible) supply chain

Ball Corp. Investor Day (Ticker: BALL) – Manufacturer of Aluminum Cans

And we're starting to see PPI inputs moderate or decline. You're seeing the problems in the port. California, 8 months ago, had 100 ships off the coast. Now it's down to 8, and those are getting processed in 24 hours. You're seeing a lot of the imbalance in supply/demand of goods that COVID created. During COVID, everybody was buying new golf clubs, a new couch, a new refrigerator. Those aren't ongoing purchases. Those are things that happened and then tail off. We're starting to see the tail-off of that. And I think that will help us from an inflationary standpoint. You're still seeing CPI. Now everything is funneling through the CPI because food and rent are very high. But in terms of our inputs, we're starting to see lower warehousing, lower transportation. Europe is a little different, where transportation is still expensive. Energy is going to get more expensive. But in general, we're starting to see some of those cost headwinds that we've had the last couple of years where we've choked out a lot of net inflation will either moderate or potentially even reverse, we're going to like that a lot.

Costco Wholesale Corp. (Ticker: COST) – Club Warehouse Retailer

A few comments regarding inflation. We've seen minor improvement in a few areas. But all in, pressures from higher commodity prices, higher wages and higher transportation costs and supply chain disruptions. They're still present, but we are seeing just a little light at the end of the tunnel. And if you recall in the third quarter, we indicated that price inflation overall was about 7% plus for us. For the fourth quarter and talking with our merchants, the estimated price inflation overall was about 8%, a little higher on the food and sundries side, a little lower on fresh foods, and both higher and lower on the nonfood side. We're seeing commodities -- some commodities prices coming down, such as gas, steel, beef, relative to a year ago, even some small cost changes in plastics. We're seeing some relief on container pricing. Wages are still the higher thing when we talk to our suppliers. And as we all know, wages still seem to be the one thing that's still relatively higher. But overall, some beginnings of some light at the end of that tunnel. And of course, that could change each week. In all, despite current inflation levels, we believe we continue to remain competitive versus others and able to raise prices as cost increases. Hopefully, of course, a little less than others with who we compete.

In terms of supply chain. Generally, supply chain has improved a little, including on-time deliveries. We started seeing container prices coming down. The first place you see it, of course, is in the spot market. And then you'll start to see it hopefully in some other contracts as they continue. No longer any big capacity issues or container shortages. Domestically, port delays have improved. And while the rail strike that was in the news a few weeks ago was thankfully averted, in anticipation of strike, there were some rail ramp closures and delays in restarting that. But the view from our buyers is that this should be eliminated for the most part towards the end of this week.

Switching over to inventory levels. Our total inventory at Q4 end was up year-over-year, just -- was up just under 26% year-over-year. At the end of the third quarter, it was up just over 26%. Of the 26% increase, an estimated 10 to 11 percentage points of it is inflation.

I think the outsized thing is just that. I mean are utilities costs up? Sure. But the outsized thing would be the wage increases. But I'm sure IT is up -- IT is always up a little more as everybody is doing more technology-wise

Re: LIFO: $30 million something, then $100 million something, then $200 million something. Part of that is, is the way we account for it is, at the end of the Q1, when we saw what the trend was, you then estimate what you believe it's going to be for the year, and pro rate 1/4 of that or 12 weeks of that to that quarter. And that as it continues to increase, you adjust it on a year-to-date basis. So that skews that a little bit. That's the way we've done it historically in prior inflationary times. The other comment you asked about is it seemed like it'd be even higher in Q4. The fact is, is we, too, thought halfway through the quarter, it would be higher than this. Part of that was if I bifurcated Q4 into the first 8 weeks and the second 8 weeks, the first 8 weeks showed a level of increase that would have required a larger LIFO charge. It seemed to, in some cases, flatten out a little bit during the last several weeks of the quarter, which meant that it came down from what our expectation was. So again, I think that is consistent with what I mentioned about we're seeing a little light at the end of the tunnel. I'm not just -- and there's little [comment] with some of the buyers about a couple of items going down in price. And you can rest assured that our partners are calling the suppliers. As you said, the price went up because of steel prices. Well, steel prices are down. What gives? And so we'll continue to do that. But it's a slow road. And -- but we are, again, seeing a little bit of improvement at least in the second half of the fourth quarter. And we'll see where it goes from here

Yes. Well, again, anecdotally, when we talked to the buyers, they're starting to see a few examples, whether it's something like outdoor patio furniture or barbecue grill where steel prices are coming down, and we're reminded by Craig and Ron, the buyers reminded at the budget meeting when prices were going up, make sure you understand why they're going up. Is it -- what piece of it is raw material costs? What piece of it is freight costs? And when these things come down, you better be on the phone with them calling them saying, when are we going to get a reduction? And so I think in part because of our limited selection -- our limited number of SKUs and a huge volume, I think our buyers know pretty darn well a lot of the cost components of these things. And that, I think, bodes well for us. But again, at the end of the day, we are seeing -- I think it is a little light at the end of the tunnel. Certainly, container rates have come down. Container shortages have improved. The port delays have improved, all that things go into it. And as raw material prices come down -- and FX generally helps you and hurt you. When we report a foreign company's earnings in U.S. dollars, and the currency has gone down 10%, it's 10% less earnings that we report. But at the same token, since we're using U.S. dollars in a lot of things, not just in the U.S. to buy different supplies and raw materials from other places, that helps you a little bit. And again, I think it's -- could something happen tomorrow to change this? Sure. But at least we're seeing the things going -- starting to go in the right direction. Hopefully, that bodes better for not just us, but everyone.

Certain commodities like corn are coming down. I mentioned the -- resin is coming down a little bit. So all these things are impacting a little bit. But in some cases, the supplier are committed at the higher priced -- we work with our suppliers. And the more transparent they are with us, which we feel they are very transparent, we work together on that. In some cases, even when commodity price has gone down fast, if they committed to the next 3 months at a higher price because they -- we all were fearful it was going even higher, we work with them on that. So I think, again, it's, at this juncture, anecdotal. And I can't give you any specific examples.

Comments