January's CPI release was the most disappointing inflation report we've gotten in at least a year, and while it's only one month of hot data, this report by itself is bad enough that it could threaten the broader disinflation narrative that had very much become consensus prior to this morning. Should we get even a remotely comparable report like this again next month, not only will rate cuts in the first half of this year go out the window, but we may need to come to grips with the possibility of no rate cuts at all in 2024. If that scenario plays out, talk of recession will likely pick up again as well, and right in the middle of a major presidential election this time. That would be messy.

Let's review this month's figures. Headline inflation for the month came in at 0.3% month-over-month, and seasonally adjusted, while core inflation (which excludes food and energy prices) increased at a 0.4% month-over-month pace. This was the fastest core increase since we saw three months in a row of +0.4% from March to May of 2023. This 0.4% increase was essentially double the consensus forecast for a ~0.2% increase. Year-over-year, the headline index increased 3.1%, down from 3.4% in December but roughly in-line with October and November's rates of increase. The core index, on the other hand, was up 3.9%, the same as last month. Below is a table showing these and other key inflation statistics:

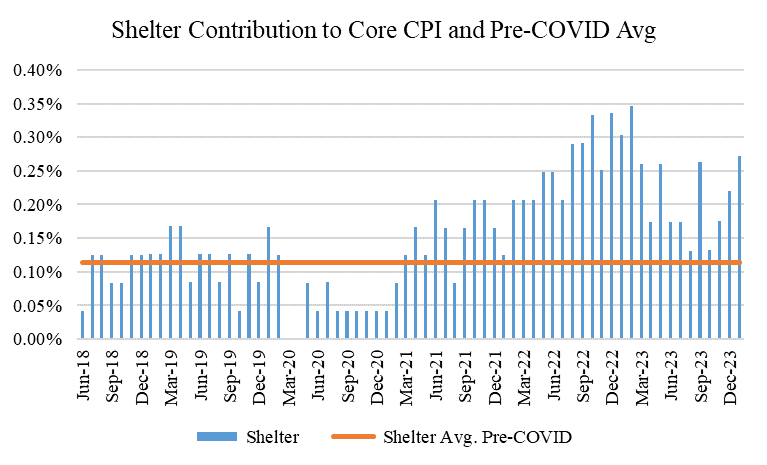

As we normally do, let's go through our three "buckets" to see what each contributed. This month, goods contributed -8 bps (driven by a large decline in used car prices which negatively contributed 9 bps just by itself), services ex. rent contributed +21 bps, and shelter contributed +27 bps. While goods excluding cars was still broadly in-line with recent months , services ex. shelter and shelter's contributions were the worst since September of 2022 and February of 2023 respectively.

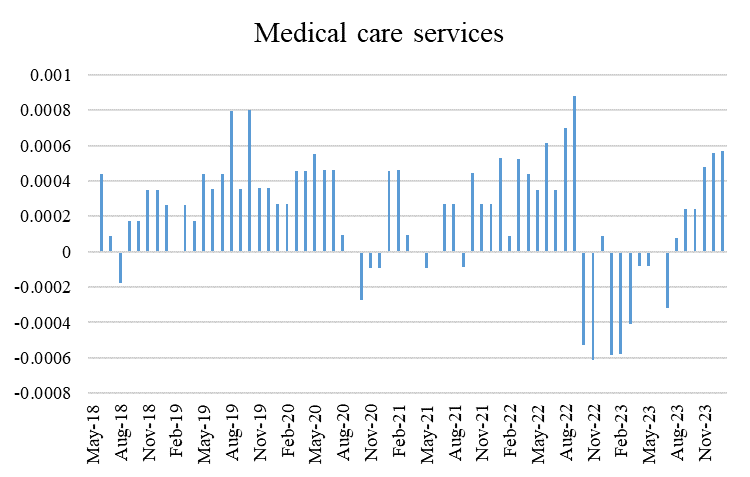

The "core" services (which excludes shelter) was particularly discouraging, since this bucket is one that the Fed is particularly focused on because of its perceived connection to the labor market. With the January jobs report showing a robust 0.6% monthly wage increase (which annualizes to over 7%, well above the 3-3.5% the Fed deems ideal for 2% price inflation), a hot core services number may force the Fed to re-think the position that it doesn't necessarily need to cause labor market pain to bring inflation back down to 2%. Chair Powell's comments at the most recent Fed meeting were particularly encouraging in this regard (encouraging in that he no longer seemed to think the Fed needed to weaken the labor market to bring price inflation back down to 2%), but after today's report, he's probably wishing he left those particular comments out of his press conference.

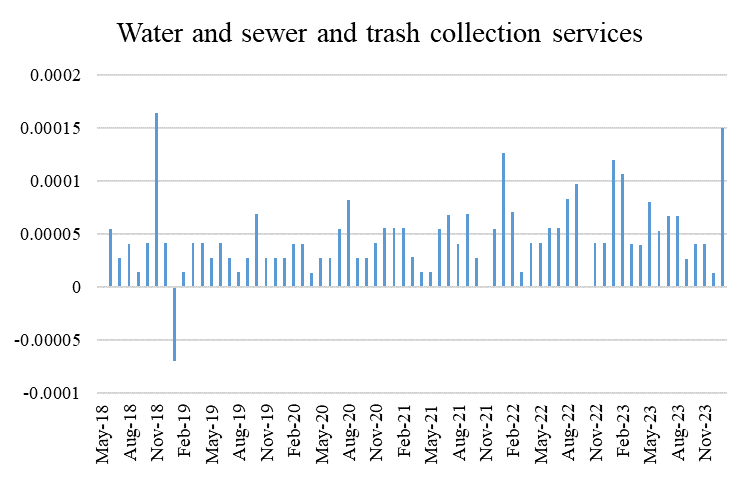

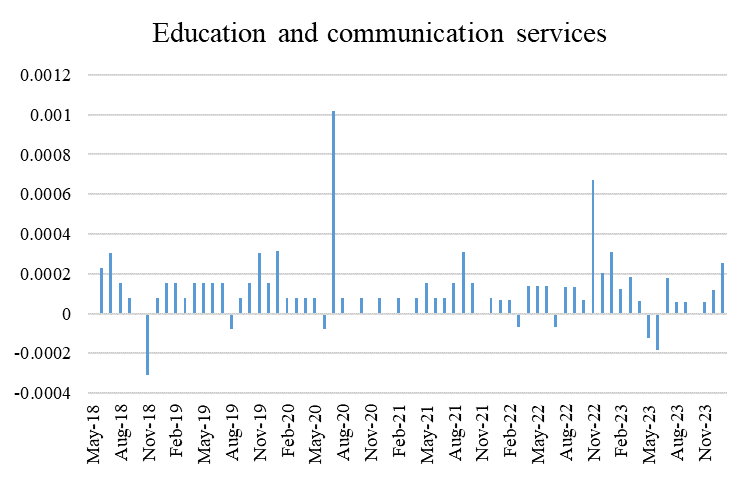

Additionally discouraging was the breadth of inflation this month, especially in core services. Many of these categories inflated at levels as bad, or at least about as bad, as they have in some time.

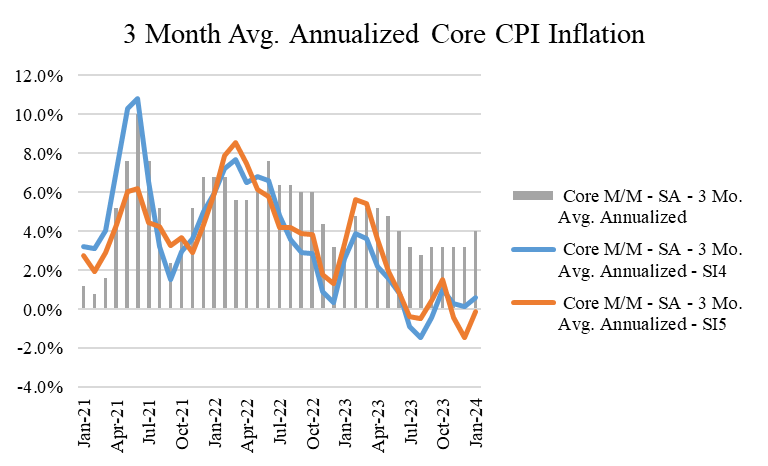

We can also look at breadth another way, which is what we usually do through our Category 4 and Category 5 average and median increases. As a reminder, Category 4 is a basket of 55 categories of goods and services that comprise about 98% of the core CPI, while Category 5 is a basket of 101 goods and services that comprises about 78% of the core CPI. Both of these figures showed large upticks this month, indicating that more categories are seeing price increases at higher levels.

If we look at 3 month averages for our category level price changes, inflation still looks under control. But even one more month like January's could send the lines back up closer to the bars (where we don't want them). As a reminder, the lines being below the bars indicates certain categories (like shelter) that make up a larger weight of the aggregate CPI index are continuing to unduly bias the index upwards.

In summary, January has been a tricky economic month in each of the last two years, and in each case showing a resurgence of economic strength after a soft 4th quarter preceding it. Time will tell if January's surge fades and the disinflation we saw for most of 2023 continues into 2024, or if we're in store for something much different.

Comments