March '24 CPI: Way Better Than It Looks

- CitizenAnalyst

- Apr 10, 2024

- 5 min read

You're likely going to hear about how we got another bad inflation report this morning, but for the first time in several months, things actually seem to be much better than expected once you look at the details. Let's review.

March CPI on a headline and core basis both increased at 0.4% this month (seasonally adjusted). This was the same as February's 0.4% increases, and unrounded, I estimate this was 0.36%, also the same as February. Year-over-year, headline CPI ticked up again (to 3.5%), while core remained at 3.8%. The table below shows many of these statistics and others. Most importantly, core inflation on a 3 month annualized basis ticked up again to 4.8%, after being as low as 2.8% last August. As we'll see in a moment though, things are not quite as they appear, as this month's inflation "miss" was largely driven by car insurance, which will abate over time, as car prices are no longer rising.

As we usually do, let's go through our three buckets.

First, goods this month improved, and the data here looked a lot more like the second half of 2023. Goods this month contributed -4 bps (excluding cars, this was zero), better than February's +2 bps gain and more in-line with the last several months of 2023.

Services Ex. Shelter increased +21 bps, which is higher than last month's +15 bps, and in-line with January's +21 bps. Most notable among the contributors of this are car insurance, which contributed +9 bps this month. This compares to +3 bps from car insurance last month, and +4-5 bps at the end of '23. Outside of the volatile months of spring of 2020, this is the highest this category has inflated in years.

Here's a chart of the monthly contribution to core CPI from car insurance. Car prices are no longer going up, and as the chart below shows, if anything are probably still falling. Car insurance reacts with a significant lag to the prices of the underlying asset (similar to shelter, which we'll discuss more in a moment), so much of the recent increases in car insurance rates is still a catch-up from the major spike in values seen during COVID. Once these rate increases are put through, however, insurance in the CPI should normalize considerably closer to historical levels (which as the chart below shows, is much closer to zero, in-line with the monthly contribution from car price increases). Absent changes in competitive dynamics in the car insurance industry (which there's not much evidence of), car insurance prices should ultimately not inflate at faster rates than the cars they're insuring.

Now here's a chart of the Manheim Used Vehicle Value Index (link here). Since used vehicle values are no longer going up, and if anything, seem to still be on the decline (and likely could fall further with the recent spike in interest rates again), this will help put pressure on car insurance rates downward.

Away from car insurance within "core" (ex. shelter) services, this month's data looked a lot better, and similar to goods, looked much more like it did the second half of 2023, though probably still a bit too high.

Let's turn briefly to shelter. Shelter remains a bugaboo within the CPI, and its stubbornness continued in March, despite rents continuing to increase at normalized rates in other publicly available data (note this comment from the report linked to above: "This month’s increase is right in line with what we saw in March of last year, as well as with the longer-run March average from 2017 to 2019."). This month's +18 bps increase in the shelter component of CPI continues to be well above historical averages (+11 is more "normal"), and for reasons that continue to be hard to understand, given what so many other data sources have been saying for months. I won't spend much time beating the dead horse here, but this has to normalize at some point.

If we take the goods contribution at essentially zero, and take this month's +12 bps increase from core services (normalized for car insurance), incorporating a normalized shelter figure of +11 bps would be combine to a monthly core CPI of +23 bps (0.23%). On an annualized basis, this number is 2.76%, within a stone's throw of the Fed's 2% target. This is the most important thing to remember from this month's report: you adjust for the spike in car insurance, and assume that it eventually normalizes (as car prices have), and then bake in some shelter normalization, and we can feel ok about the inflation picture again. In a speech just last week (4/3), Fed Chair Powell said "the recent data do not, however, materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2 percent on a sometimes bumpy path." This month's data supports that notion, despite "headline" evidence to the contrary. This is a welcome change from the last couple months, where I would argue the data did not support that thesis.

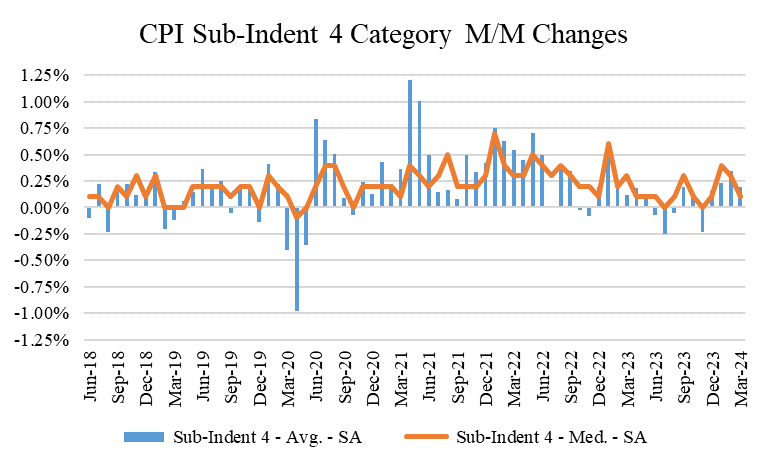

Let's quickly review category level data before we wrap up. As a reminder, we like to look at two layers of category level data within the CPI. We call these "Level 4" and "Level 5." Level 4 represents a collection of 55 goods and services categories that makeup 98% of the core CPI. Level 5 represents a basket of 101 goods and services categories that make up 77% of the core CPI. In recent months, these numbers had started to flare up, which was one of the things that concerned me most. Thankfully this month, these figures have receded, and are again much more in-line with levels consistent with 2% inflation. For the month, the median and average increases within these baskets were 0.10% and 0.19% for Level 4, and 0.1% and 0.28% for Level 5.

Because of the jumps in January and February, however, the 3 month figures still look discouraging. But regardless, this month was encouraging in that it seems to indicate perhaps January and February were in fact exceptions, and driven more by enhanced seasonality or other factors than by a durable spike in inflation.

Bottom line, this month's inflation report was better than it looked, the first time we've been able to say that this year. This doesn't mean there wasn't anything to dislike in this report (core services were still probably too high, just not intolerably so), but it does provide some evidence for the notion that we're still moving in the right direction on inflation. It may take some time for the car insurance headwind to abate (I personally just saw my rates increased by 35%, despite my car value going down), but as long as car prices don't spike again, this pig should work its way through the python and the headwind eventually go away (resulting in a lower CPI). We'll need more than one month worth of "reversion" data to feel decent about the inflation picture again, but one month is a good place to start.

Kommentare